In order for a candle to be a valid hammer most traders say the lower wick must be two times greater than the size of the. Cara Cepat Menguasai Candlestick.

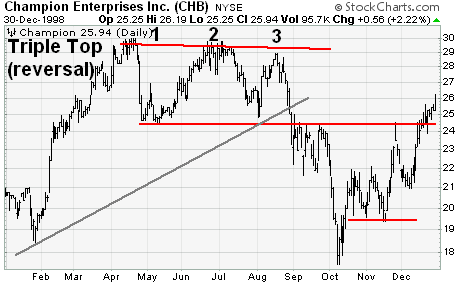

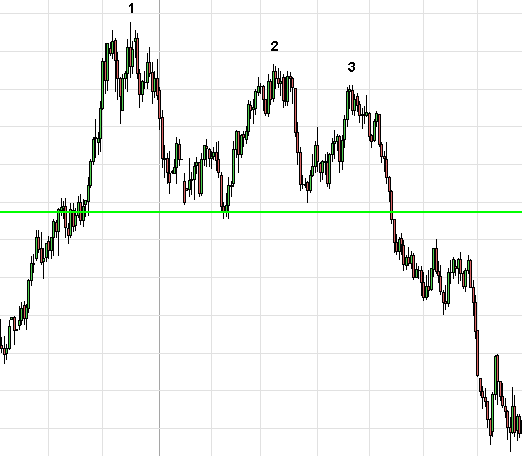

Trading The Double Top And Triple Top Reversal Chart Patterns

Triple Candlestick Pattern Pahami Triple Candlestick Pattern.

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-02-f2c3428399574d4181d943daf126cf77.jpg)

. Prices move up from first low with increase volume up to a level to complete the left shoulder formation and then fall down to a new low. Sekarang waktunya bagi Anda untuk mulai memahami pola terakhir yang cukup populer dari candlestick pattern yaitu tripe candlestick pattern. Selesaikan course mengenai candlestick pattern ini.

A corrective reaction on low. A real double top is an extremely bearish technical pattern which can lead to an extremely sharp decline in a stock or asset. A recovery move follows that is marked by somewhat more volume than seen before to complete the head formation.

The formation is upside down and the volume pattern is different from a Head and Shoulder Top. Sudah paham dengan pola dual candlestick pattern. A hammer is a type of bullish reversal candlestick pattern made up of just one candle found in price charts of financial assetsThe candle looks like a hammer as it has a long lower wick and a short body at the top of the candlestick with little or no upper wick.

The Complete Guide To Triple Top Chart Pattern

What Are Triple Top And Bottom Patterns In Crypto Trading Bybit Learn

Triple Top Pattern Explained Stock Chart Patterns

Triple Top Reversal Chartschool

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

0 comments

Post a Comment